Forex trading can be a lucrative career, but it requires knowledge, discipline, and the right strategies. To navigate the complexities of the foreign exchange market effectively, traders need to adopt best practices that can enhance their chances of making profitable trades. Whether you are a beginner or an experienced trader, here are some essential forex trading tips to consider. For more resources and trading options, visit forex trading tips https://exglobal.pk/.

1. Educate Yourself Continuously

The forex market is constantly evolving, with new strategies, tools, and regulations coming into play. To remain competitive, it’s crucial to engage in continuous education. Start by reading books on forex trading, attending online courses, and participating in webinars. Always keep an eye on market news and economic indicators that can affect currency values.

2. Develop a Trading Plan

Successful trading often hinges on having a well-defined trading plan. A trading plan should outline your goals, risk tolerance, strategies, and rules for entering and exiting trades. Make sure to stick to your plan to avoid emotional decision-making, which can lead to losses.

3. Understand Technical and Fundamental Analysis

Mastering both technical and fundamental analysis can give you a significant edge in the forex market. Technical analysis involves analyzing price charts and indicators to predict future price movements. Fundamental analysis, on the other hand, examines economic news and reports, such as interest rates, employment figures, and GDP growth, to gauge the overall economic health of a country and its currency.

4. Manage Your Risk

Risk management is crucial in forex trading. Never risking more than 1-2% of your trading capital on a single trade can help protect your funds from significant losses. Use stop-loss orders to automatically close trades that reach a specified loss limit, and diversify your portfolio to spread risk across different currency pairs.

5. Use Leverage Wisely

Leverage allows you to control larger positions with a smaller amount of capital. While this can amplify your profits, it also escalates your risks. Always use leverage cautiously and ensure that you fully understand its implications before amplifying your trading positions. A good rule of thumb is to moderate your leverage ratio to align with your risk tolerance and trading strategy.

6. Keep Emotions in Check

Trading can be an emotional rollercoaster. Fear of missing out (FOMO), greed, and anxiety can cloud your judgment and lead to impulsive decisions. To trade effectively, cultivate discipline and emotional resilience. Keeping a trading journal can help you reflect on your decisions and stay grounded.

7. Stay Informed About Market News

The forex market is influenced by geopolitical events, economic reports, and central bank decisions. Staying informed about these factors can give you an advantage. Sign up for financial news alerts, follow reliable economic calendars, and always have a grasp on major global events that could impact currency fluctuations.

8. Use a Demo Account

Before risking real money, practice your trading strategies using a demo account. Most brokers offer demo accounts that simulate real trading conditions without financial risks. This is a great way to familiarize yourself with the trading platform, test different strategies, and build your confidence before transitioning to a live account.

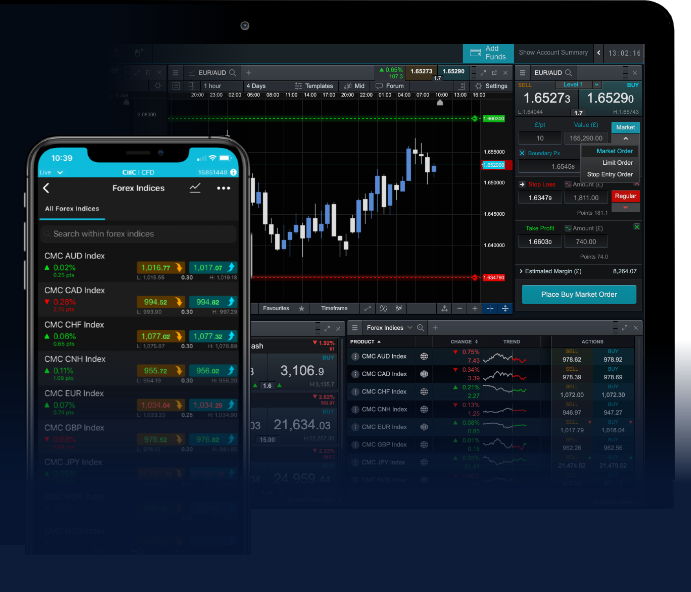

9. Choose the Right Broker

Selecting a regulated and reputable forex broker is crucial for your trading success. Look for brokers that offer competitive spreads, a user-friendly platform, and excellent customer service. Read reviews, check their regulatory status, and ensure they provide a trading environment aligned with your needs.

10. Network with Other Traders

Connecting with other traders can provide valuable insights and learning opportunities. Join trading forums, attend local trading meetups, or participate in online communities to share experiences, strategies, and tips. Collaborating with others can foster a sense of accountability and support.

Conclusion

Forex trading can offer exciting opportunities, but it’s essential to approach it with a clear strategy and a commitment to continuous learning. By implementing these forex trading tips—educating yourself, managing risks, practicing with demo accounts, and staying informed—you can position yourself for greater success in the dynamic world of foreign exchange markets. Remember, every trader’s journey is unique, so find what works best for you and stick with it.